Jewellery Industry Overview

Global Perspective:

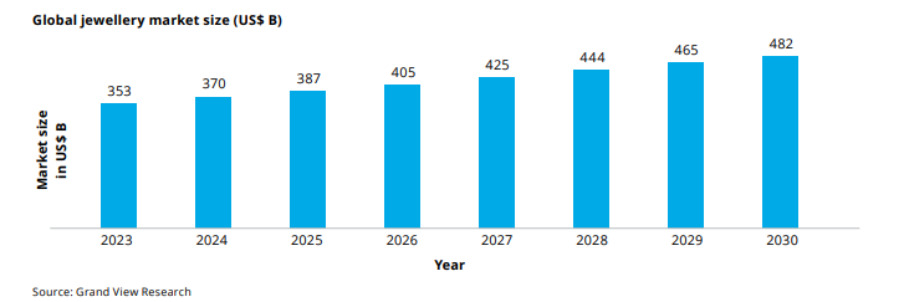

- Market Size and Growth: The global jewellery market was valued at $353 billion in 2023 and is projected to reach $482 billion by 2030. This substantial growth underscores the increasing emphasis on customer retention strategies, including loyalty programs.

- Impact of Loyalty Programs: Loyalty programs have been shown to boost revenue by 12% to 18%. Given the high value and occasional purchase nature of jewellery, brands are keen on implementing loyalty initiatives to encourage repeat business.

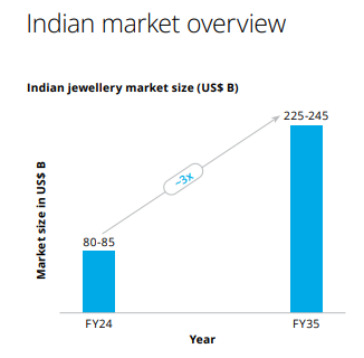

Indian Context:

- Market Dynamics: The Indian jewellery market was valued at approximately $85.52 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. This growth trajectory highlights the potential for loyalty programs to play a pivotal role in customer retention.

- Loyalty Program Adoption: The loyalty market in India is projected to grow from $4.79 billion in 2023 to $8.02 billion by 2028, reflecting a CAGR of 10.5% during 2024-2028. While this encompasses various sectors, the jewellery industry’s contribution is noteworthy, especially with organized players capturing over 30% of total market sales.

- Consumer Engagement: Research indicates that loyalty schemes significantly influence one in five customers, with 92% of women and 86% of men being members of such programs.

This high engagement level suggests that jewellery brands investing in loyalty initiatives can effectively enhance customer retention. Both global and Indian markets recognize the value of these initiatives in driving customer retention and revenue growth. As the industry continues to evolve, investing in tailored loyalty programs will likely remain a strategic priority for jewellery brands aiming to foster lasting customer relationships.

Comparison of engagement rates for different loyalty models

Comparing engagement rates between gold savings programs and points-based loyalty programs in the jewellery industry reveals distinct advantages and considerations for each model.

Gold Savings Programs:

Gold savings programs allow customers to contribute regular payments toward future gold purchases, often offering benefits like price protection and additional bonuses. These programs are particularly popular in markets like India, where gold holds cultural and financial significance.

Points-Based Loyalty Programs:

Points-based programs reward customers with points for each purchase, redeemable for discounts, products, or exclusive experiences. This model is widely adopted across various retail sectors.

Engagement Rates and Impact on Sales:

Specific engagement rates for these programs in the jewellery industry are not extensively documented. However, insights from other sectors offer valuable perspectives:

- Points-Based Programs: Companies like Starbucks have demonstrated that well-structured points-based programs can significantly boost customer retention and sales. For instance, Starbucks’ Rewards members account for 60% of its sales, highlighting the potential of such programs to drive repeat business.

- Gold Savings Programs: While specific data is limited, the cultural resonance of gold savings programs in markets like India suggests high engagement, particularly among customers planning substantial future purchases. These programs not only encourage regular investments but also strengthen customer loyalty by aligning with traditional financial practices.

Loyalty Members vs. Regular Buyers: Who Spends More?

General Impact of Loyalty Programs:

- Increased Profitability: Businesses with loyalty programs are, on average, 88% more profitable than those without.

- Millennial Engagement: 46% of millennial consumers in India are willing to spend on brands with loyalty programs, compared to 40% of Baby Boomers and 39% of Gen X.

What Customers Want: Top-Rated Jewellery Loyalty Benefits

Existing studies and industry insights highlight several key aspects that customers value:

1. Personalized Services:

Customers in the luxury sector, including jewellery, increasingly seek personalized experiences that cater to their individual preferences and needs. This personalization enhances the overall shopping experience and fosters deeper customer loyalty.

2. Exclusive Access and VIP Treatment:

Loyalty programs that offer exclusive access to new collections, private events, or personalized consultations are highly valued by customers. Such VIP treatments make customers feel special and appreciated, strengthening their connection to the brand.

3. Quality and Uniqueness:

While not a direct loyalty benefit, the inherent quality and uniqueness of jewelry pieces play a crucial role in customer satisfaction and loyalty. Customers are more likely to remain loyal to brands that consistently offer high-quality and distinctive products.

Tanishq vs. Malabar vs. Kalyan: Loyalty Program Impact on Retention & Engagement

Net Promoter Score (NPS) and Customer Preferences:

A study assessing customer loyalty and satisfaction in the jewellery sector reported the following:

- Kalyan Jewellers: 25% of respondents identified Kalyan as their preferred jewellery store, with an NPS of 55.28.

- Tanishq: 16% of respondents favoured Tanishq, which achieved a higher NPS of 61.54.

- Malabar Gold & Diamonds: 9% of respondents chose Malabar as their usual store, with an NPS of 56.82.

These figures suggest that while Kalyan Jewellers has a larger customer base among respondents, Tanishq customers exhibit higher satisfaction levels.

Loyalty Programs and Customer Retention Strategies:

- Tanishq: Operates the ‘Golden Harvest Scheme,’ a loyalty program that encourages regular savings towards future jewellery purchases. This program not only promotes consistent customer engagement but also enhances retention by aligning with customers’ financial planning for jewellery investments.

- Kalyan Jewellers: Offers the ‘Dhanvarsha’ scheme, allowing customers to make monthly installments over 11 months to purchase gold, diamonds, and other jewellery. This structured savings plan caters to customers aiming for systematic investment in jewellery.

- Malabar Gold & Diamonds: Provides a diverse range of jewelry collections and designs, appealing to various age groups. However, specific details about their loyalty programs are not extensively documented in the available sources.

Revenue Growth and Market Position:

In the first quarter of the fiscal year 2025, the brands reported the following revenue growth:

- Tanishq: Achieved a 9% growth rate.

- Kalyan Jewellers: Recorded a more substantial increase of approximately 24%.

These figures indicate Kalyan’s aggressive expansion and growing market presence, though it’s essential to consider that these growth rates are based on different revenue bases.

Real-World Wins: How Loyalty Programs Boost Jewellery Sales

Bluestone, a prominent Indian jewellery retailer, has implemented the Gold Mine 10+1 Plan, a loyalty program designed to enhance customer engagement and retention. This program allows customers to make 10 monthly installments, with Bluestone contributing the 11th installment, thereby facilitating systematic savings towards jewellery purchases.

Key Features of the Gold Mine 10+1 Plan:

- Structured Savings: Customers commit to 10 monthly payments, with the added benefit of Bluestone funding the 11th installment, effectively increasing the purchasing power for their desired jewellery items.

- Flexibility: The plan offers flexibility in payment amounts, enabling customers to choose installments that align with their financial capabilities.

- Exclusive Benefits: Participants gain access to exclusive designs and early previews of new collections, enhancing their shopping experience.

Impact on Customer Engagement and Satisfaction:

A study focusing on Bluestone’s Shivranjani store in Ahmedabad evaluated the effectiveness of the Gold Mine 10+1 Plan on customer engagement. The findings revealed:

- Participation Rate: Approximately 47.12% of respondents were enrolled in the Gold Mine 10+1 Plan, indicating a substantial adoption rate among customers.

- Customer Satisfaction: Among the participants, 25.64% expressed satisfaction with the program, highlighting its positive reception.

- Recommendation Likelihood: A significant portion of satisfied customers indicated a willingness to recommend the program to others, suggesting enhanced customer loyalty.

Impact of Loyalty Programs: Investment vs. Revenue Boost in Jewellery Industry

General Impact of Loyalty Programs:

- Revenue Growth: Companies with robust loyalty marketing programs experience revenue growth 2.5 times faster than their competitors and generate returns to shareholders that are 100-400% higher.

- Customer Retention: Implementing loyalty programs can contribute up to 20% of a company’s profits, as 84% of consumers are more likely to stay with a brand offering such programs. Additionally, 66% of customers report that the ability to earn rewards influences their spending behaviour.

Customer Lifetime Value (CLV): Loyalty Members vs. Regular Buyers

In the jewellery sector, enhancing CLV involves strategies such as offering personalized experiences, exclusive access to new collections, and special discounts for loyalty program members. These initiatives aim to strengthen customer relationships and encourage repeat purchases.

General Impact of Loyalty Programs on CLV:

- Increased Spending: Loyalty program members tend to spend more than non-members. For instance, research shows that loyal customers spend 31% more, on average, compared to new customers.

- Higher Revenue Contribution: Members of loyalty programs generate 12-18% more incremental revenue growth per year than non-members.

Tech-Driven Jewellery: AI Recommendations, AR/VR Trials.

Jewellery brands are increasingly integrating advanced technologies such as Artificial Intelligence (AI), Augmented Reality (AR), and Virtual Reality (VR) to enhance customer experiences through personalized recommendations and virtual try-on solutions.

By analysing customer data, including past purchases and browsing behaviours, AI enables jewellery brands to offer tailored product suggestions:

Blockchain in Jewellery: Gold Savings & Authenticity Assurance.

Blockchain has increasingly emerged as a powerful tool for gold savings and authenticity assurance in the jewellery industry. Several companies have implemented blockchain-based solutions to address key challenges in tracking, verifying, and safeguarding high-value assets such as gold. Here are some notable approaches:

- Gold Savings Plans with Blockchain-backed Tokens:

Companies like Paxos Trust Company have launched products such as Paxos Gold (PAXG), where each token is backed 1:1 by physical gold stored in highly secure vaults (e.g., London Bullion Market Association–accredited facilities). This setup allows customers to participate in gold savings programs digitally, enjoy faster and more secure transactions. - Authenticity Assurance via Blockchain for Precious Metals:

Initiatives like the TrustChain Initiative launched by De Beers and its partners leverage blockchain technology to trace and authenticate diamonds and precious metals across the entire supply chain—from mining to the final retail product. - Combining Blockchain with Smart Contracts for Automated Verification:

Such systems not only assure consumers that their jewellery is genuine and ethically sourced, but they also facilitate smoother transactions by automating aspects of compliance and audit through smart contracts.

Future of Digital Loyalty Programs: 5-Year Forecast

Over the next five years, digital loyalty programs in the jewellery industry are expected to see robust growth as more brands invest in mobile‐first and AI‐driven solutions. Based on broader digital loyalty trends—with global digital loyalty markets forecast to expand at a CAGR of about 8–9%—jewellery brands, which already rely heavily on emotional engagement and high-value purchases, are likely to adopt these programs at a similar or even accelerated pace.

Key factors driving this growth include:

- Increased Mobile and E-Commerce Adoption:

As more customers shop online and via mobile apps, jewellery brands will integrate digital wallets and app-based reward systems. In markets like India and Europe, where e-commerce penetration is high, digital loyalty tools will become essential to capture and engage consumers. - Personalization Through AI and AR/VR:

Advanced analytics and augmented reality try-on features are already enhancing customer experiences. These innovations enable brands to offer tailored rewards, personalized recommendations, and interactive virtual try-on experiences—all of which drive repeat purchases and deepen brand loyalty. - Omnichannel Integration:

Digital loyalty programs will increasingly bridge the gap between online and offline experiences, ensuring that customers earn and redeem rewards seamlessly whether they shop in-store or online.

Mobile Apps & E-Commerce Are Redefining Loyalty Programs

Mobile applications and e-commerce platforms are revolutionizing traditional loyalty models in the jewellery industry by enhancing customer engagement, offering personalized experiences, and integrating advanced technologies. Here’s how these digital tools are reshaping customer loyalty:

1. Enhanced Customer Engagement through Mobile Apps

Mobile apps serve as direct communication channels between jewellery brands and customers, facilitating real-time interactions and personalized experiences. Key benefits include:

- Product Showcasing: Apps allow brands to display their collections with high-quality images and detailed descriptions, enabling customers to explore products at their convenience.

- Push Notifications: Brands can send timely updates about new arrivals, exclusive offers, and events, keeping customers informed and engaged.

- Data Collection: Mobile apps enable data mining, allowing brands to analyze customer preferences and purchasing patterns to tailor offerings accordingly.

2. Personalized Loyalty Programs via E-commerce Platforms

E-commerce platforms facilitate the creation of customized loyalty programs that cater to individual customer preferences:

- Tiered Rewards: Implementing tier-based loyalty programs encourages increased spending by offering escalating benefits, such as exclusive discounts or early access to new collections.

- Experiential Rewards: Offering unique experiences, like invitations to private events or personalized services, enhances brand affinity and customer retention.

- Hybrid Loyalty Models: Combining online and offline loyalty initiatives ensures a seamless customer experience across all touchpoints.

3. Direct-to-Consumer (DTC) Models

E-commerce platforms enable jewellery brands to adopt DTC models, fostering direct relationships with customers:

- Personalized Communication: Direct interactions allow for tailored marketing efforts, enhancing customer loyalty.

- Exclusive Offerings: Brands can provide unique products or services exclusive to their online platforms, incentivizing repeat purchases.

Jewellery brands focus on trust, personalization, and long-term value to drive customer loyalty. Programs like gold savings schemes and loyalty memberships enhance financial benefits and emotional connections. Brands like Tanishq and Malabar demonstrate high effectiveness in maintaining engagement through innovative initiatives and consistent customer touchpoints. By leveraging ROI metrics, these companies can optimize their strategies and sustain strong customer relationships.