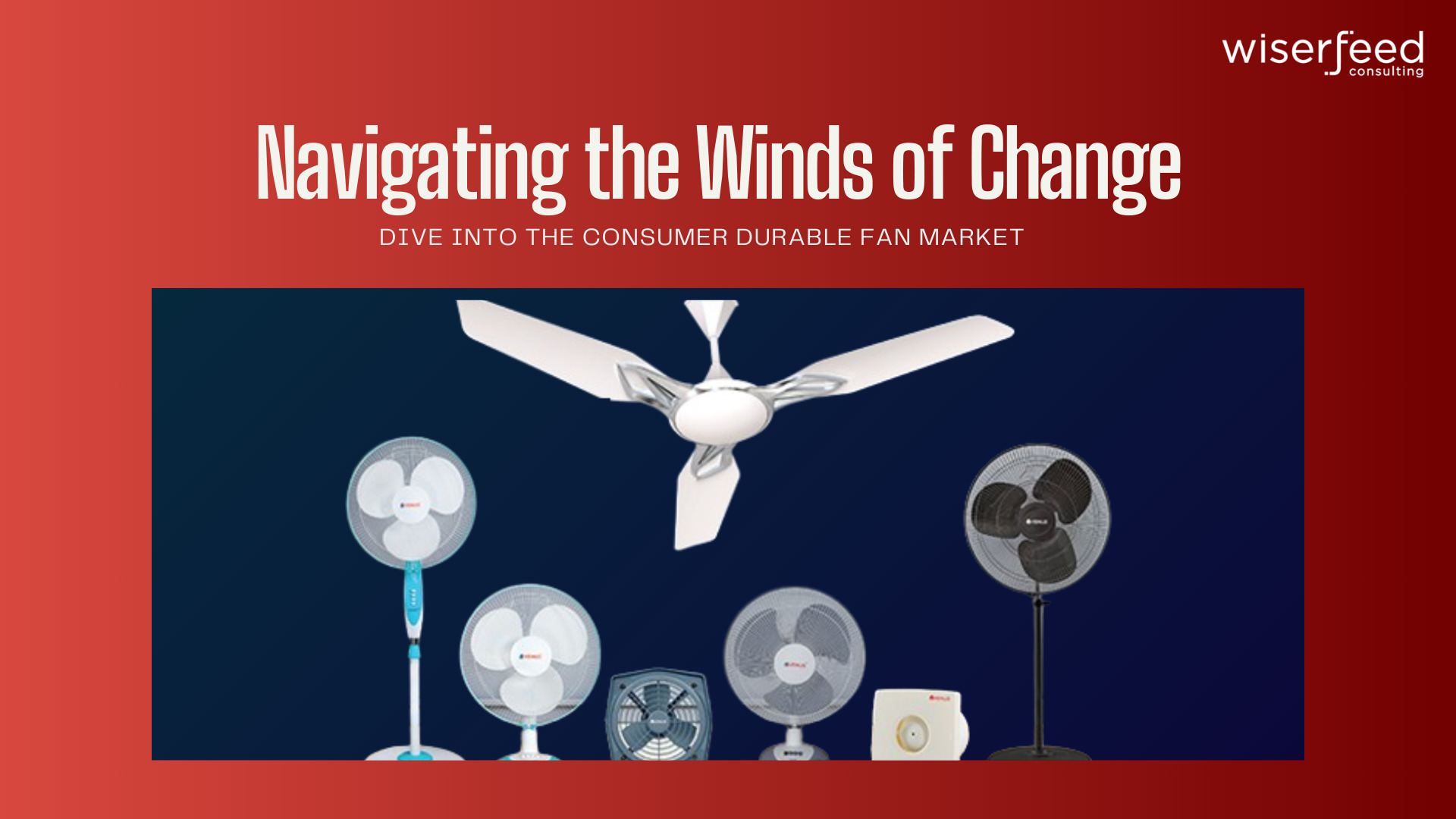

The consumer durable fan market in India has evolved significantly over the past decade, transitioning from a basic necessity to a lifestyle choice influenced by energy efficiency, aesthetics, and technology. With major players like USHA, Havells, Orient Electric, Crompton, and Bajaj Electricals driving the industry forward, the sector is poised for substantial growth. This article decodes trends, challenges, and opportunities, providing actionable insights based on authentic data sources.

Industry Overview and Market Size

The Indian fan market was valued at approximately USD 2.65 billion in 2022 and is projected to grow at a CAGR of 6.5%, reaching USD 3.6 billion by 2028.

- The market’s growth is primarily fueled by urbanization, which stood at 36.3% of India’s population in 2022 (World Bank).

- Penetration in rural markets has expanded due to 90% electrification under Saubhagya Yojana by the government (Ministry of Power, 2023).

- Energy-efficient appliances contribute significantly, with BLDC fans increasing from 10% market share in 2019 to 22% in 2023 (BEE, 2023).

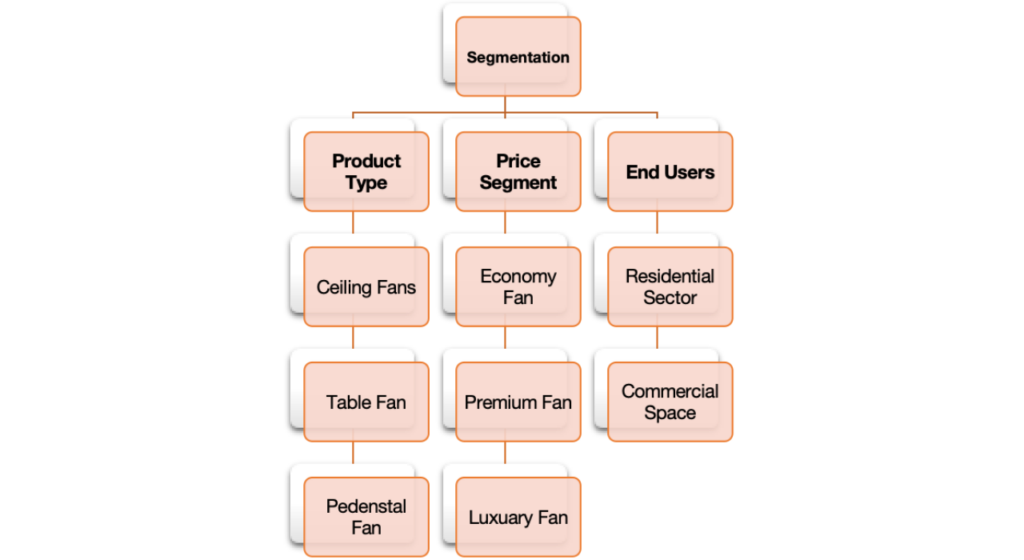

Market Segmentation

By Product Type

- Ceiling Fans dominate the market with 60% share, driven by urban and rural demand alike (IBEF, 2022).

- Table Fans hold 15% market share, popular in semi-urban regions with erratic power supply.

- Pedestal Fans, with a growth rate of 7% annually, are preferred for industrial and outdoor uses (Statista, 2023).

By Price Segment

- Economy Fans (<₹1,500) account for 50% of rural demand, catering to cost-sensitive households.

- Premium Fans (₹2,000–₹5,000) saw a 15% YoY increase in demand due to middle-class adoption.

- Luxury Fans (>₹5,000), featuring IoT capabilities, contribute 5% to overall revenue, but this niche is growing at a CAGR of 18% (Technavio, 2023).

By End-User

- The residential Sector comprises 75% of total demand, spurred by rapid housing developments.

- Commercial Spaces, particularly in urban areas, contribute 15%, while industrial use accounts for the rest.

Fan Market Trends

Energy Efficiency and Sustainability

- Fans with BLDC motors save 40-50% of electricity, appealing to environmentally conscious consumers (Bureau of Energy Efficiency, 2023).

- BEE reports that 45% of fan sales in 2023 were energy-efficient models, expected to reach 55% by 2025.

IoT-Enabled Smart Fans

- Havells’ IoT-enabled fan sales grew by 12% in FY23, leading the smart fan segment.

- The smart appliance market, valued at USD 1.25 billion in 2022, is growing at a CAGR of 14% (Statista, 2023).

Premiumization

- Premium decorative fans contribute to 12% of total sales, reflecting the shift towards stylish and functional products (FICCI, 2023).

Rural Market Expansion

- Rural electrification has increased fan sales by 38% since 2020 (NSSO, 2023).

Seasonal Demand

- Peak sales occur in Q1 and Q2, accounting for 65% of annual revenue, driven by summer heatwaves (IBEF, 2023).

Key Developments and Innovations

- BLDC Technology

- Crompton and Havells launched BLDC fans claiming Rs. 1,000 annual savings per fan on electricity bills (Company Reports, 2023).

- Smart Fans

- Orient Electric partnered with Google to integrate voice controls, boosting its smart fan portfolio to 20% market share in this segment (Economic Times, 2023).

- Eco-Friendly Initiatives

- USHA aims to reduce carbon footprint by 25% through sustainable practices by 2025 (CSR Report, 2023).

- Rural Focus

- Bajaj Electricals’ affordable fan series saw 30% YoY growth in rural markets (Statista, 2023).

Challenges and Opportunities

Challenges

- High Competition: Margins are under pressure, with average profit margins dipping to 8-10% for entry-level models (IBEF, 2023).

- Adoption Barriers: Advanced technologies like BLDC remain costly, limiting accessibility for lower-income households.

Opportunities

- Government Incentives: Subsidies for energy-efficient appliances under schemes like the National Energy Policy (2022).

- Rising Disposable Income: India’s middle class is expected to grow by 25% by 2030, increasing demand for premium products (World Economic Forum, 2023).

- Export Potential: Demand for Indian-made fans in Africa and Southeast Asia grew by 18% in 2022 (EXIM Bank, 2023).

Actionable Insights for Industry Stakeholders

- Expand R&D on BLDC: Developing cost-effective variants to bridge the affordability gap can unlock mass adoption.

- Enhance IoT Features: Invest in smart functionalities to cater to the growing demand for connected devices.

- Target Rural Markets: Strengthen distribution in Tier-3 cities and beyond, where electrification continues to rise.

- Adopt Eco-Friendly Practices: Promote sustainable manufacturing to align with consumer preferences and regulatory norms.

Wiserfeed Consulting has been instrumental in providing data-driven insights to stakeholders navigating this evolving landscape. With expertise in consumer behaviour analysis, market trends, and strategic planning, Wiserfeed empowers businesses to make informed decisions and maintain a competitive edge in the fan market.

Conclusion

The Indian fan market, driven by innovation, sustainability, and urbanization, is poised for robust growth. By leveraging trends such as energy efficiency and smart technology, and addressing affordability challenges, companies can solidify their position in this competitive sector. The future belongs to those who adapt and innovate, riding the winds of change toward long-term success.