In developed markets like the UK and the US, subscription-based ownership models have already crossed 10% of monthly household incomes. We are now subscribing for literally everything, from mobile phone packages to even shaving blades…Dollar Shave Club, anyone? So, let’s delve inside this growing yet undiscovered market with a global as well as a local perspective.

The Rise of Luxury Subscription Models in Personal Care

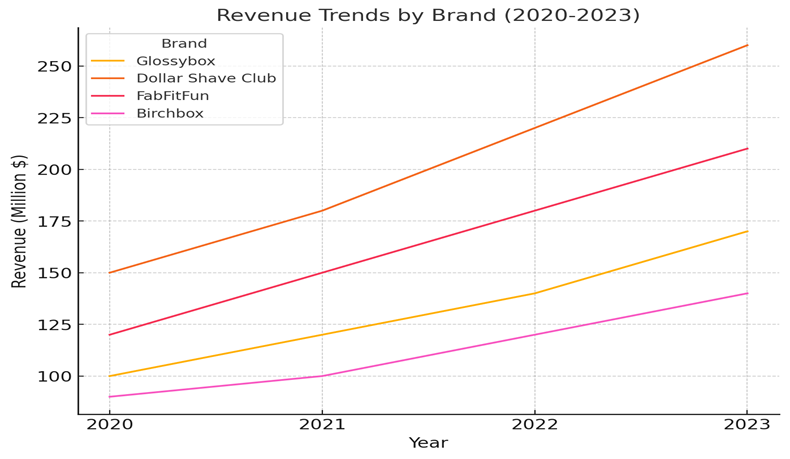

According to a 2023 McKinsey report, the global subscription economy grew by 70% between 2019 and 2022, with luxury segments experiencing a 35% growth rate.

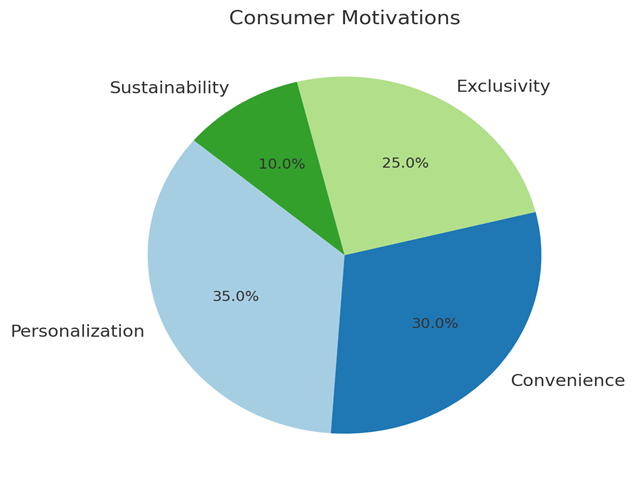

Beauty discovery subscription boxes like Birchbox, IPSY and GLOSSBOX have capitalized on consumers’ desire for curated, personalized beauty products. The consumers are drawn to the convenience of having beauty essentials or surprises delivered to their door, eliminating the need for repeated trips to brick-and-mortar stores.

The success of these boxes can be attributed to several factors:

- Personalization: Brands use data collected through quizzes and customer feedback to tailor products, enhancing user experience.

- Discovery: Consumers are introduced to new and niche brands they may not have encountered otherwise, expanding their beauty horizons.

- Affordability: Subscriptions often provide a variety of high-end products at a fraction of their retail price.

Case Study: BirchBox

Birchbox’s introduction of premium grooming kits featuring high-end products saw a 25% increase in customer retention and a 40% rise in average order value.

Birchbox, launched in 2010 by Katia Beauchamp and Hayley Barna, is a pioneer in the beauty subscription box industry.

Consumer Challenges

1. Overwhelming Product Choice: The beauty industry is saturated with thousands of products, from skincare to makeup, haircare, and fragrances. This abundance of choice can overwhelm consumers, making it difficult to find products that meet their specific needs and preferences.

2. Risk of Purchasing Full-Sized Products: Consumers are often hesitant to invest in full-sized beauty products without trying them first. The risk of spending money on a product that may not work for them results in consumer reluctance and potential dissatisfaction.

3. Lack of Personalized Recommendations: The traditional beauty shopping experience often lacks personalization, with consumers receiving generic product recommendations that do not account for their unique preferences and needs.

Competitive Analysis

Analysing direct competitors in the beauty subscription box market provided insights into Birchbox’s positioning and differentiation:

- Glossybox: Known for its luxurious packaging and high-end product selections, Glossybox targeted a similar demographic but focused on premium brands.

- Ipsy: Ipsy offered a more customizable experience with its Glam Bags, allowing subscribers to choose some of the products they received.

- Sephora Play: Sephora’s subscription service leveraged its established brand and offered subscribers access to exclusive and popular beauty products.

Campaign Success Factors for Birchbox’s Subscription Model Campaign

The success of Birchbox’s Subscription Model Campaign can be attributed to several key factors that played a crucial role in achieving the campaign’s objectives.

1. Clear Objectives and Goals: The campaign was designed to support Birchbox’s broader business objectives, including market expansion and revenue growth, ensuring that all efforts were aligned with the company’s strategic vision.

2. Targeted Audience Segmentation: Utilizing data insights to target specific audience segments through digital advertising, social media, and email marketing ensured that the campaign reached the most relevant potential subscribers.

3. Compelling and Relevant Messaging: The use of captivating visuals, compelling taglines, and strong calls-to-action captured audience attention and motivated them to take action.

4. Data-Driven Optimization

- Performance Tracking: Regular tracking of key metrics such as click-through rates (CTR), conversion rates, and cost per acquisition (CPA) provided insights into campaign performance and areas for improvement.

- A/B Testing: Implementing A/B testing for ads, messaging, and offers helped identify the most effective strategies and optimize campaign elements for better results.

Market Growth and Challenges

India saw a remarkable 32.8% growth in luxury goods sales in FY22, outpacing major markets like the US, Switzerland, Japan, and China. This rapid growth is a testament to the increasing appetite for luxury products among Indian consumers. Major brands like Dior, Louis Vuitton, Coach, and Balenciaga have expanded into India, often releasing India-exclusive collections. Indian companies like Reliance and Aditya Birla are also heavily investing in the luxury sector. Additionally, global investment firms are showing interest, indicating confidence in India’s luxury potential. If we look at global pictures the luxury subscription model in particular is on a rise:

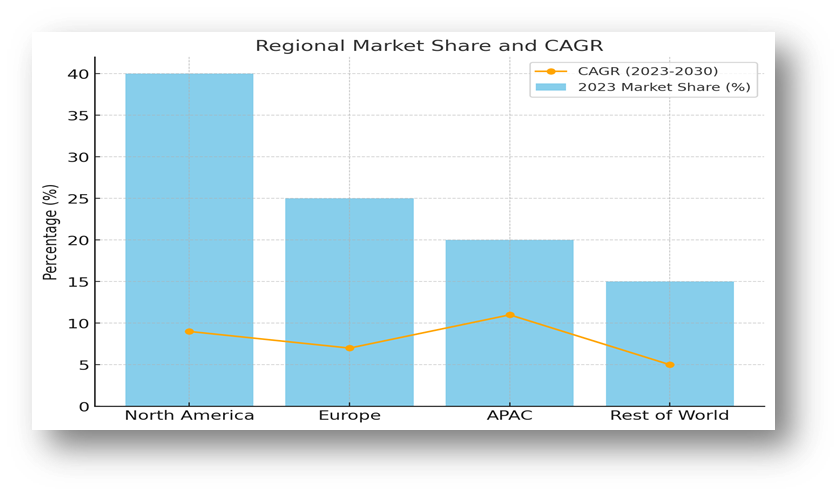

- Projected CAGR: The luxury subscription market is expected to grow at a compound annual growth rate (CAGR) of 8.9% from 2023 to 2030.

- Geographic Trends: High growth in North America and APAC regions due to increased disposable income.

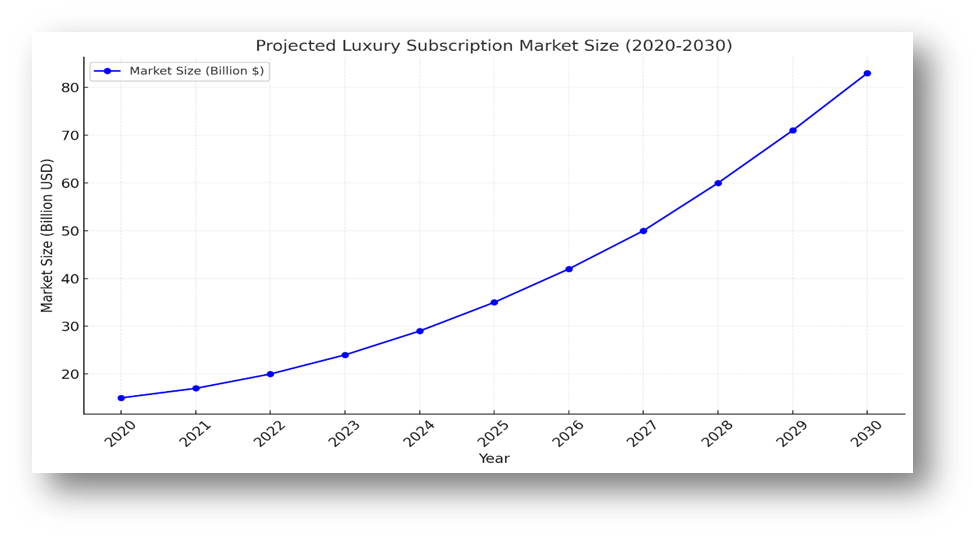

- Market Size Projections: The global luxury subscription market size was valued at $15 billion in 2020 and is projected to reach $83 billion by 2030, driven by demand for premium personalized services.

There are challenges too faced by the brands in some past years which are:

- Retention: The brands are spending a huge amount in acquiring a customer but finding hard to get repeat purchase from them. The acquisition costs with long-term customer value is not looking viable right now due to the fierce competition.

- Sustainability: Today’s consumer is very conscious about aligning luxury with environmentally conscious practices. This is creating a challenge for the brands.

- Competition: This a particularly a niche market, so the market is comparatively saturated, with the presence of so many brands makes it more big of a challenge.

Strategies for Scaling Luxury Subscriptions

Understanding the various revenue models of subscription businesses is crucial for long-term success. Here are some key models and how to leverage them.

- The Freemium Model: This is where you offer a basic service for free but charge for the best features or upgrades. It’s an excellent way to hook customers and then upsell to a subscription.

- The Usage Model: With this model, customers pay based on how much they use your service. It’s great for services that can easily adapt to customer needs and provide transparent pricing.

- The Tiered Model: By offering different service levels at different price points, you can cater to a broader range of customers.

- The Perks Model: Offering perks, like insurance, discounts or freebies, can make your service more appealing.

The key to a thriving subscription business is its ability to adapt, create continuous value and foster a strong sense of community.

These are the projected market size of the industry which clearly shows that this industry is currently in a bullish trend, and is expected to do so. The brands have to be quick on grabbing the opportunities along with reassess their models and strategies, etc. These are the some points they should keep in mind:

- Focus on retention: Focus on retaining existing customers, which can be more cost-effective than acquiring new ones.

- Improve customer engagement: Reduce churn and build long-term relationships by providing regular updates, personalized recommendations, and listening to customer feedback.

- Upsell and cross-sell: If you have multiple subscription plans, upsell campaigns can convince prospects to upgrade to higher plans. With a captive audience, you can also introduce additional products or services.

- Launch reward programs: Launch reward programs with partner offers and triggered incentives.

Track monthly recurring revenue: Monthly recurring revenue (MRR) is a good indicator of revenue growth or decline. It can also help you forecast earnings and understand your base revenue.