Winter is not only the season of blankets and the hot beverage but also of skincare. It is the best time for cold creams in the FMCG sector as the Indian skincare market continues to grow steadily. With consumers becoming more dynamic and diverse, the product segment changes with evolving preferences, innovation, and competitive trends.

Understanding the Market Landscape

The Indian cold cream market is a booming sector of the overall skincare market. According to recent statistics:

- The Indian facial creams and gels market is growing at a CAGR of 9% and is expected to reach INR 20,500 crore by 2028. A large part of this growth comes from cold creams, particularly during the winter season.

- This growth is mainly due to the addition of consumer preference in the products. Indian consumers are attracted towards the products that feature natural ingredients. This means the Indian consumers are getting more health conscious about their choices.

- There are also other attributes in this list: SPF Protection, Price Sensitivity and Brand Attributes.

- This dynamic market landscape has paved the way for a few key players who dominate the Indian cold cream sector with innovative products tailored to meet the ever-changing consumer preferences.

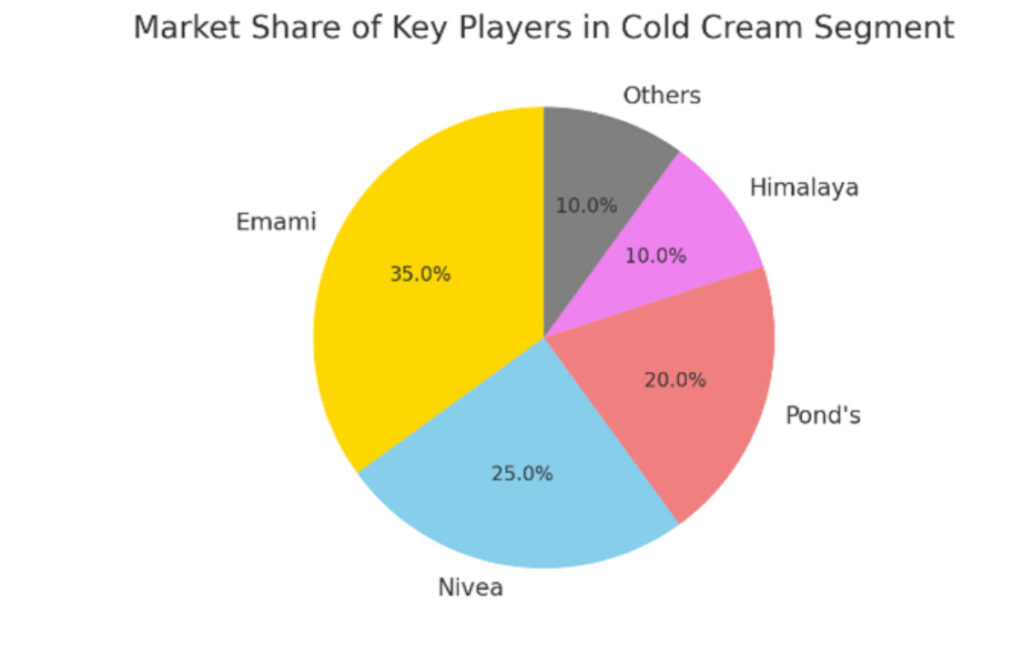

Major Players in the Indian Cold Cream Market

The winter skincare industry of India is dominated by a few key players who have revolutionized the sector through innovative products and strategic positioning. Here is a closer look at their flagship products, their market impact, and the reasons behind their success:

- Boro Plus (Emami): It is an antiseptic brand that holds more than 74% market share in its category. Its flagship brand is Boro Plus Antiseptic Cream.

The reason why it leads:

- Multi-use: It provides antiseptic care, moisturizing, and healing for dry and chapped skin

- Rich heritage: Built on decades of trust and a loyal consumer franchise

- Affordability and accessibility: Readily available across urban and rural India.

- USP: Ayurvedic formulation with natural ingredients like turmeric and aloe vera makes it a reliable choice for all-round winter care

2. Nivea: This is a leader in moisturizing creams, especially

catering to Indian winters.

- The reason why it leads:

- Lightweight yet deeply hydrating: A favorite among urban consumers who prefer non-greasy creams.

- Dermatologically tested and enriched with Vitamin E and jojoba oil.

- Strong brand trust worldwide for quality skincare.

- USP: Suitable for Indian winters, offering high hydration without grease appeal, thus attracting the younger age groups.

3. Pond’s (HUL): A brand name for generations, a cold cream classic, and the name is synonymous with generations. Its leading product is Pond’s Cold Cream

- The reason it leads:

- Long-tried formula: Gives deep nourishment and has been associated with winter skincare for years.

- Luxury at a low cost: Offers luxury care at a modest cost.

- High recall: Heavy advertising and presence in popular culture make it a staple for winter.

- USP: Its heritage and ease of use make it a staple product for crores in India.

4. Himalaya Herbals: It is an emerging force in the herbal and organic play. It’s the best-selling product is Himalaya Nourishing Skin Cream

- Why It Tops:

- Herbal and organic: taps into the increasing demand for natural and chemical-free products.

- Enriched with aloe vera, winter cherry, and many more natural ingredients.

- Fast-growing consumer base through its emphasis on Ayurveda.

- USP: Suits the environment-conscious and the health-conscious, thereby creating space in the herbal skincare market.

They dominate the Indian winter skincare market as their brands embody heritage, innovation, and insight into consumer needs. Emerging trends and changes in consumer preferences driving the growth of the market are also fuelled by the success of the key players in shaping this industry.

Key Trends Driving Growth

- Product Innovation: Natural and Ayurvedic trends are being adopted in the cold cream market, from Himalaya and Boro Plus to turmeric, aloe vera, and winter cherry. Consumers also seek multi-functional products, such as SPF-infused creams for dryness and UV protection. Multi-in-one solutions like Nivea Soft serve to convenience, as versatile products for face, body, and hands.E.g.: Himalaya’s Nourishing Skin Cream experienced 30% year-on-year growth in sales when it promoted the herbal composition of the product through its digital campaigns that focused on its appeal to the health-conscious consumer.

- Digital Presence: Brands are increasingly using artificial intelligence to trace consumer trends, predict patterns of consumer behaviour, and work out targeted communications. Shocking 40% has been the increase in Winter skincare sales digitally through portals like Nykaa and Amazon due to marketing efforts.E.g.: Nivea India recently collaborated with the influencers for a #SoftWinter campaign on Instagram that witnessed online sales to increase by 25 percent in just a month.

- Sustainability: A green conscious consumer is forcing companies to turn green first: starting from recyclable pack like Nivea adopting sustainable material, or minimalism in formulation with fewer chemicals to appeal to a purchaser who is sensitive to nature.E.g.: A 2023 Nielsen report shows that 72% of Indian consumers want products from brands with sustainable practices, making companies rethink their supply chain strategy.

- Targeted Campaigns: Data-driven strategies help brands connect with their audience, taking analytics as the core tool for campaign building in an audience’s view of insight. Marketing through local dialects and regional influencers leads to better penetration into niche markets.E.g.: Pond’s Cold Cream ran a regional campaign in North India during peak winter months tied to the local festivals and values. Result: 15% spurt in the market share in the region.

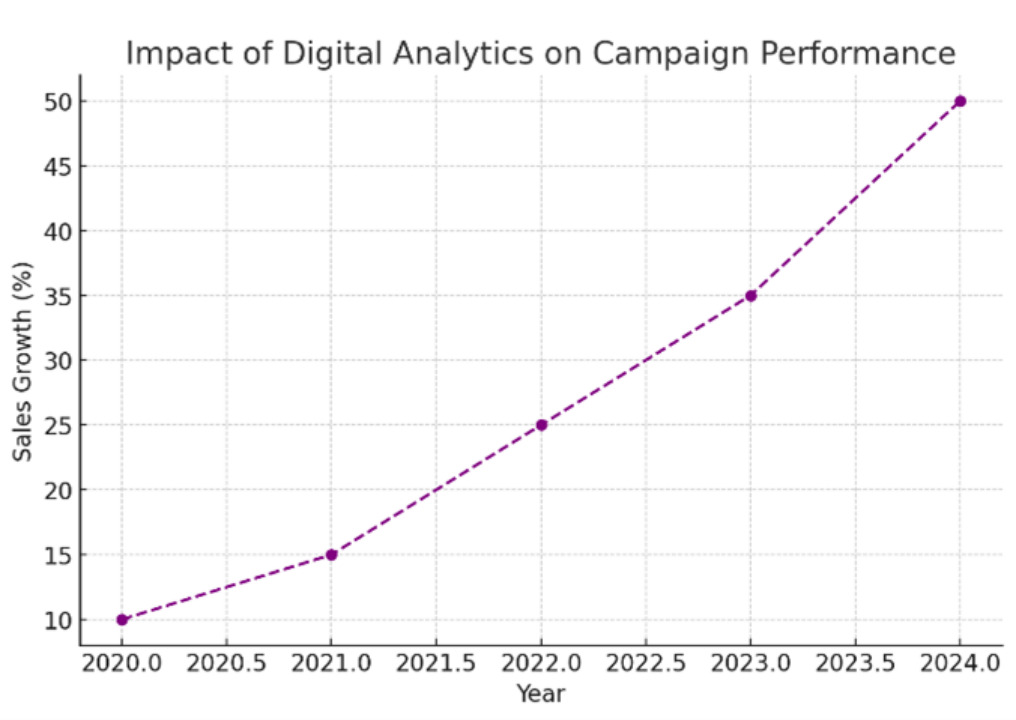

These evolving trends underline the growing importance of analytics, which play a pivotal role in shaping strategies and maximizing impact in the cold cream market.

Analytics in Decision-making

- The diagram below shows continuous growth in sales, from 10% in the year 2020 up to 50% in the year 2024 based on adoption of digital analytics.

- The cold cream company ‘Nivea’ is using analytic data and forecasting the weather to gain insight into increased demand of winter. Stockouts get reduced and have optimal supply.

- Herbals company ‘Himalaya’ initiated targeted advertisement campaigns considering the consumer behavior of the society. The retained customer value increased by 20% in the year 2023.

- Analytics tools helped Pond’s measure the success of its regional campaigns, which contributed to a 35% market share growth in 2023.

- E-commerce Focus: Digital platforms exploited data-driven strategies that would fuel more online engagement and capitalize on the growing demand. These developments highlight the significance of analytics in enabling growth as it allows the brand to align its strategies with changes in consumer behavior and the market.

Conclusion

Indian cold cream market continues to boom. This boom is because of innovation, consumer preference, and strategic decision-making, which is driven by analytics. With chillier winters and rising consumer consciousness, the cold cream market is moving upward. At this juncture, the brands making the appropriate combination of traditional wisdom and modern analytics will be the key winners in this fast-evolving market.