- E2Ws as the Catalyst for Mass EV Adoption

The low cost of running electric two-wheelers (E2Ws) compared to traditional petrol-powered vehicles, coupled with rising fuel prices, makes them a compelling choice for Indian consumers.

As a result, E2Ws are playing a pivotal role in India’s transition to electric mobility. This shift is crucial for meeting the country’s climate goals and reducing its dependence on oil imports, thereby improving energy security and economic sustainability.

- Market Momentum: Disruption in Sales and Market Dynamics

- Explosive Growth: Unprecedented Year-on-Year Surge

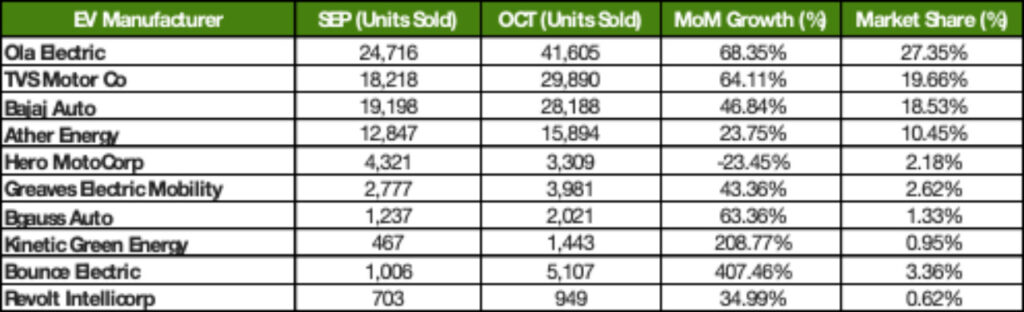

- Electric two-wheeler retail sales in October 2024 recorded 1,39,031 units, marking a strong month for major EV manufacturers. Notably, October brought a significant increase in sales, reflecting the dynamic nature of the market.

- By 2025, sales are expected to cross 10 million units annually.

- Explosive Growth: Unprecedented Year-on-Year Surge

- Comparison with ICE 2-wheelers

- Electric two-wheelers now account for over 5% of total two-wheeler sales in India, up from 3.2% in 2023-24. This indicates a significant shift in consumer preference towards electric mobility.

- Cost Differential: The economic benefits of E2Ws remain a key driver of adoption. E2W running costs are as low as ₹0.15/km compared to ₹2/km for petrol vehicles, creating strong economic incentives for consumers.

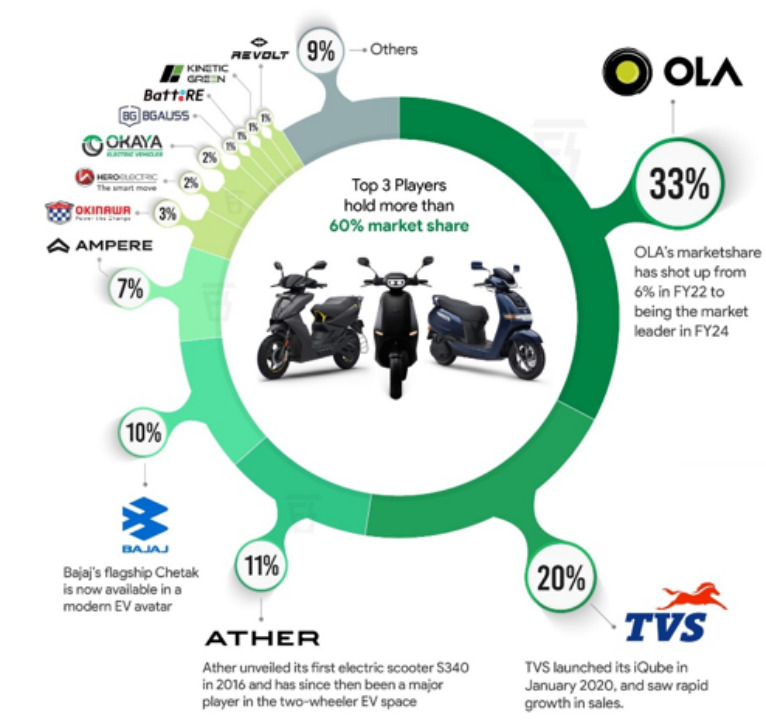

- Top Players Dominating the Market

- Ola Electric, capturing nearly 33% market share, followed by TVS, Ather Energy and Bajaj.

- Ola Electric, TVS, Ather Energy, and Bajaj have emerged as the dominant players in the electric two-wheeler market, collectively capturing a significant market share. This dominance is primarily attributed to their strategic approach, encompassing aggressive pricing, cutting-edge technology, and a robust distribution network.

- Ola Electric, for instance, has successfully leveraged aggressive pricing to attract a wide customer base. Models like the S1 Pro offer competitive pricing within their respective segments, making electric mobility more accessible to consumers. This, coupled with innovative features like the Move OS operating system and advanced battery technology, has contributed to Ola’s rapid growth and market leadership.

- Ather Energy, on the other hand, has focused on premiumization and technological innovation. Their flagship model, the 450X, boasts impressive performance, long-range, and advanced connectivity features. By establishing a strong presence in major cities and expanding its dealership network, Ather has solidified its position in the premium electric scooter segment.

- In contrast, TVS and Bajaj have capitalized on their established brand reputation and extensive distribution networks to introduce a range of electric two-wheelers at various price points. Models like the TVS iQube and the Bajaj Chetak have gained popularity due to their reliable performance, ease of use, and widespread availability.

By effectively combining aggressive pricing, technological advancements, and a strong distribution network, these leading players have propelled the growth of the electric two-wheeler market in India. As the industry continues to evolve, these companies are poised to further innovate and shape the future of sustainable mobility.

- Government Power Play: Policy Shifts Catalysing E2W Adoption

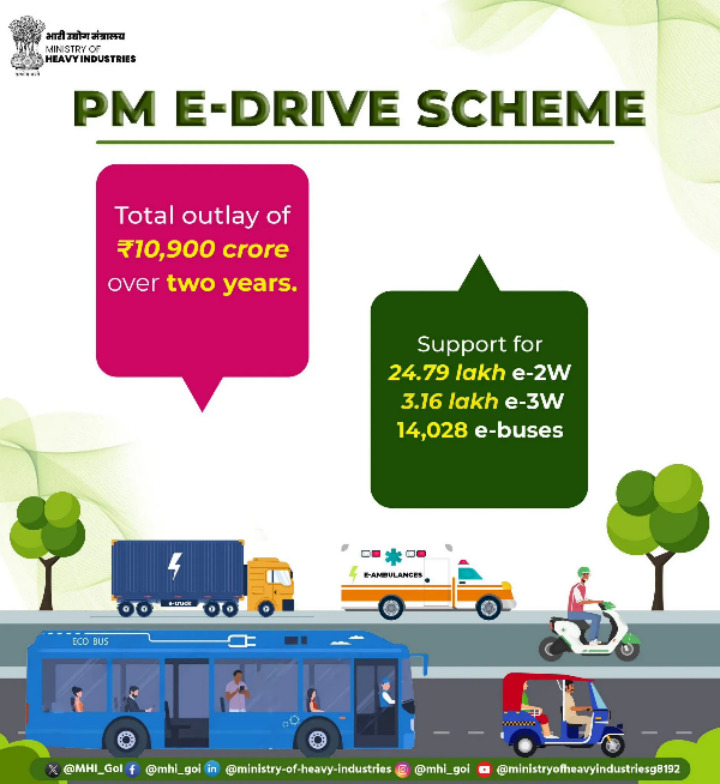

- PM E-Drive Scheme

- The newly introduced electric vehicle (EV) subsidy scheme, PM E-Drive, will provide a subsidy of Rs 10,000 for each electric 2-wheeler sold until March 2025. The affordability has led to a significant increase in demand for E2Ws, especially in urban areas.

- The scheme has incentivized manufacturers to invest in research and development, resulting in a wider variety of E2W models.

- PM E-Drive has contributed to the growth of the EV ecosystem in India by promoting domestic manufacturing and technology development.

- State-wise Incentives Creating a Competitive Landscape

- In states like Maharashtra and Delhi, additional state subsidies reduced E2W prices further by up to ₹15,000 per unit, making electric scooters more accessible.

- PM E-Drive Scheme

- Major Roadblocks: What’s Slowing the EV Boom?

- Battery costs and global supply chain vulnerabilities:

- Lithium-ion batteries continue to be a major cost component of E2Ws, accounting for around 40-50% of the price.

- While battery prices have declined in recent years, they are still relatively high, limiting the affordability of E2Ws for many consumers.

- India’s reliance on imports from China for battery materials and cells remains a key bottleneck. This exposes the country to supply chain risks, such as disruptions due to geopolitical tensions or trade wars.

- Infrastructure gaps:

- India currently has a limited number of public charging stations, which is a major barrier to the adoption of E2Ws.

- The government has set a target of installing 1 million charging stations by 2030, but this will require significant investment and coordination.

- Range anxiety remains a concern for many potential E2W buyers, especially in Tier-2 and Tier-3 cities where charging infrastructure is limited.

- Consumer hesitation due to safety concerns:

- Several battery fire incidents involving E2Ws have been reported in India, which has raised concerns about the safety of these vehicles.

- The lack of standardized safety regulations for E2Ws, particularly for battery quality and thermal management systems, has further contributed to consumer hesitation.

- Other challenges:

- The high cost of financing E2Ws remains a barrier for many consumers.

- The lack of awareness about the benefits of electric vehicles among the general public is also a challenge.

- Battery costs and global supply chain vulnerabilities:

- Innovation at the Heart of Change: Technological Disruption

- Battery Swapping: Redefining Convenience and Reducing Costs

- Companies like Bounce and Sun Mobility are rolling out battery-swapping stations, allowing users to exchange depleted batteries in under 2 minutes, eliminating range anxiety and upfront battery costs.

- Fast Charging Tech Gaining Ground

- New solid-state batteries and ultra-fast charging solutions are expected to reduce charging time to 15 minutes by 2025, giving E2Ws a 100 km+ range per charge.

- AI and IoT-Driven Mobility

- Brands like Ather Energy are leading the charge with data-driven insights via connected dashboards, enabling users to optimize battery life, monitor performance, and anticipate maintenance.

- Battery Swapping: Redefining Convenience and Reducing Costs

- Future Vision: What Lies Ahead for India’s Electric 2-Wheeler Market

- 5-Year Outlook: Rapid Transition to E2Ws

- By 2030, electric 2-wheelers are projected to constitute 35% of total 2-wheeler sales, driven by price parity with internal combustion engine (ICE) counterparts and expanded infrastructure.

- Integration with MaaS and Smart City Initiatives

- E2Ws will play a crucial role in Mobility-as-a-Service (MaaS) platforms, with companies like Yulu and UberMoto expanding shared electric scooter fleets, aligning with smart city initiatives.

- E2Ws will play a crucial role in Mobility-as-a-Service (MaaS) platforms, with companies like Yulu and UberMoto expanding shared electric scooter fleets, aligning with smart city initiatives.

- 5-Year Outlook: Rapid Transition to E2Ws

- Conclusion:

- The convergence of policy, technology, and consumer demand positions 2024 as India’s tipping point for mass electric 2-wheeler adoption.

- For India to fully capitalize on the EV revolution, collaboration between industry leaders, policymakers, and consumers is imperative. Without addressing infrastructure gaps and supply chain vulnerabilities, the momentum may slow.