Exploring current trends, challenges, and opportunities for a thriving agricultural future.

A vital part of India’s agricultural sector, the fertilizer business helps to provide food security for the country’s expanding population. Given that most Indians rely on agriculture as their primary income source, fertilizers are extremely important. This blog will look at the current situation of the Indian fertilizer market, the difficulties it faces, and the prospects for expansion and improvement.

The Current State of the Fertilizer Industry–

India ranks among the world’s top fertilizer consumers. The three main types of fertilizers produced in the nation are nitrogenous (N), phosphatic (P), and potassic (K), or NPK fertilizers. Diammonium phosphate (DAP) is the most used phosphatic fertilizer, whereas urea is the most often used nitrogenous fertilizer.

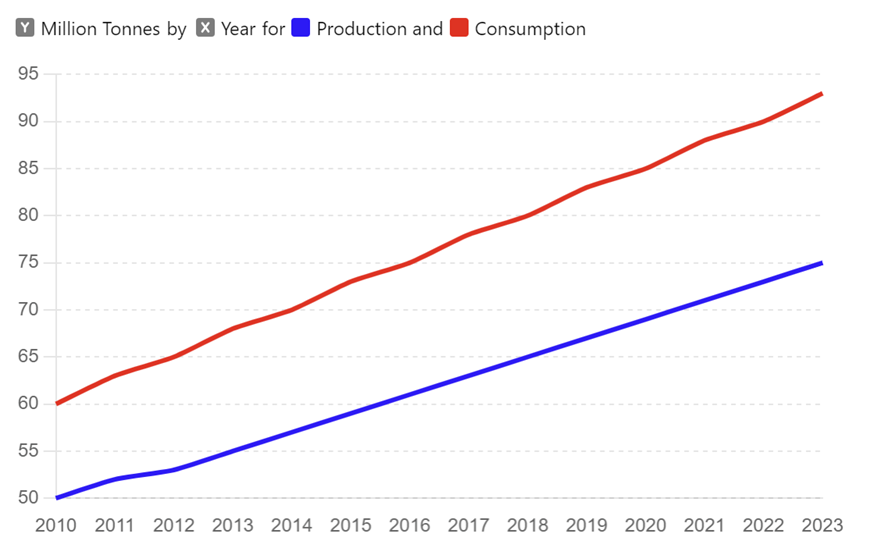

Production and Consumption Trends–

Over the years, India’s fertilizer production has steadily increased. However, there are now a lot of imports because domestic manufacturing cannot keep up with the rising demand. The biggest example of the disparity between production and consumption is the potassic fertilizers, which come from imports only.

Categorizing the Segments of Different Fertilizers–

The fertilizer industry is vast and diverse, catering to various agricultural needs. Fertilizers are broadly categorized based on their composition and application. Here are the primary segments:

- Nitrogenous Fertilizers: These fertilizers supply nitrogen, an essential nutrient for plant growth. Examples include urea and ammonium nitrate.

- Phosphate Fertilizers: These provide phosphorus, crucial for root development and energy transfer within the plant. Common types include Monoammonium Phosphate (MAP) and Diammonium Phosphate (DAP).

- Potash Fertilizers: These are rich in potassium, which helps in water retention, disease resistance, and overall plant health. Muriate of Potash (MOP) is a widely used potash fertilizer.

- Organic Fertilizers: Derived from natural sources like compost, manure, and bone meal, these fertilizers improve soil structure and fertility over time.

- Micro-nutrient Fertilizers: These contain essential micro-nutrients like zinc, manganese, and boron, which are necessary in small amounts for the healthy growth of plants.

- Specialty Fertilizers: These include controlled-release and water-soluble fertilizers, which provide a steady supply of nutrients over an extended period, reducing the need for frequent applications.

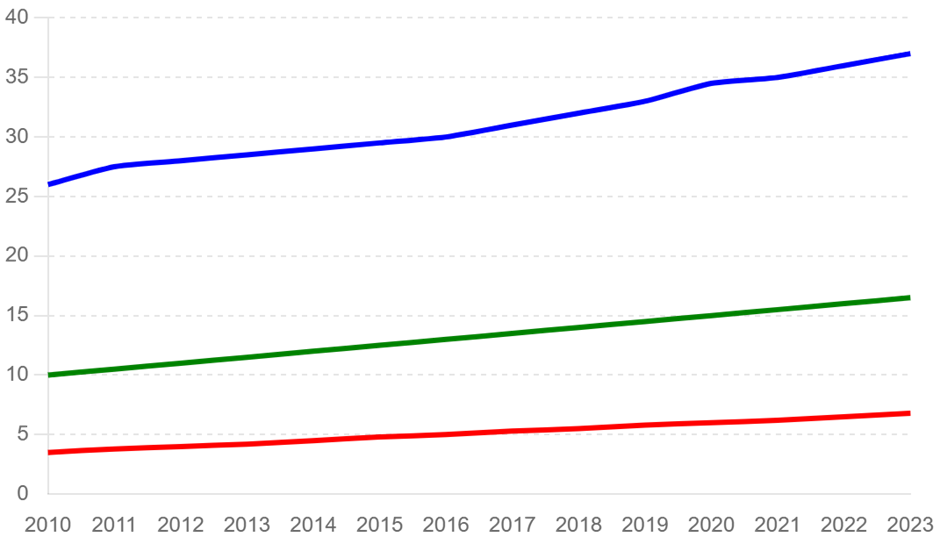

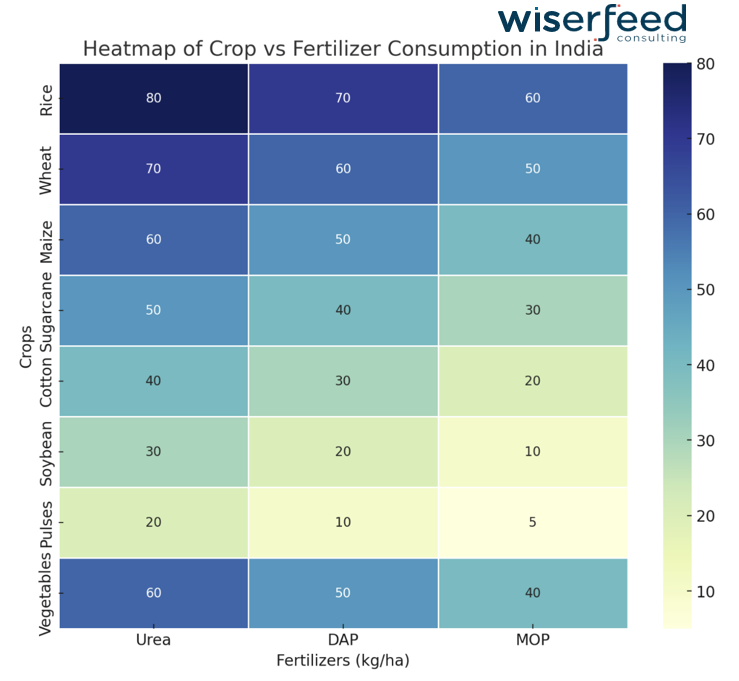

The heatmap above provides a visual representation of the consumption of different fertilizers (Urea, DAP, and MOP) for various crops in India. The data indicates the amount of fertilizer used per hectare (kg/ha) for each crop, offering insights into the agricultural practices and fertilizer application rates across different crop types.

Key Insights

- Rice:

- Rice exhibits the highest consumption of Urea at 80 kg/ha, indicating its heavy reliance on nitrogenous fertilizers.

- DAP and MOP usage are also significant at 70 kg/ha and 60 kg/ha, respectively, reflecting the comprehensive nutrient requirements for rice cultivation.

- Wheat:

- Wheat has a high Urea consumption at 70 kg/ha, second only to rice.

- DAP usage stands at 60 kg/ha, and MOP at 50 kg/ha, suggesting balanced fertilization practices for wheat.

- Maize:

- Maize sees a relatively balanced fertilizer application with Urea at 60 kg/ha, DAP at 50 kg/ha, and MOP at 40 kg/ha.

- Sugarcane:

- Sugarcane has moderate fertilizer consumption with Urea at 50 kg/ha, DAP at 40 kg/ha, and MOP at 30 kg/ha.

- Given the long growth cycle and high biomass of sugarcane, these rates indicate efficient nutrient management practices.

- Cotton:

- Cotton shows lower consumption rates with Urea at 40 kg/ha, DAP at 30 kg/ha, and MOP at 20 kg/ha, likely reflecting its specific nutrient requirements.

- Soybean:

- Soybean, being a leguminous crop, naturally fixes nitrogen, resulting in lower Urea usage at 30 kg/ha.

- DAP and MOP usage are also minimal at 20 kg/ha and 10 kg/ha, respectively.

- Pulses:

- Pulses have the lowest fertilizer consumption among the crops listed, with Urea at 20 kg/ha, DAP at 10 kg/ha, and MOP at 5 kg/ha.

- This is consistent with their nitrogen-fixing capability, reducing the need for nitrogenous fertilizers.

- Vegetables:

- Vegetables show substantial fertilizer usage with Urea at 60 kg/ha, DAP at 50 kg/ha, and MOP at 40 kg/ha.

- This indicates the intensive nutrient demand of vegetable crops to ensure high yields and quality produce.

Conclusion

India’s fertilizer market is expanding rapidly thanks to improvements in farming techniques and rising consumer demand for environmentally friendly farming supplies. Through comprehension of the distinct segments and judicious application of fertilizer for diverse crops, the industry may sustainably assist the agricultural sector, guaranteeing both food security and financial steadiness.